ATTENTION: BUSINESS OWNERS

ATTENTION: BUSINESS OWNERS

"If Your Business Was Shut Down Due To Federal Or State Mandates You Could Be Eligible For Up To $26,000 PER EMPLOYEE"

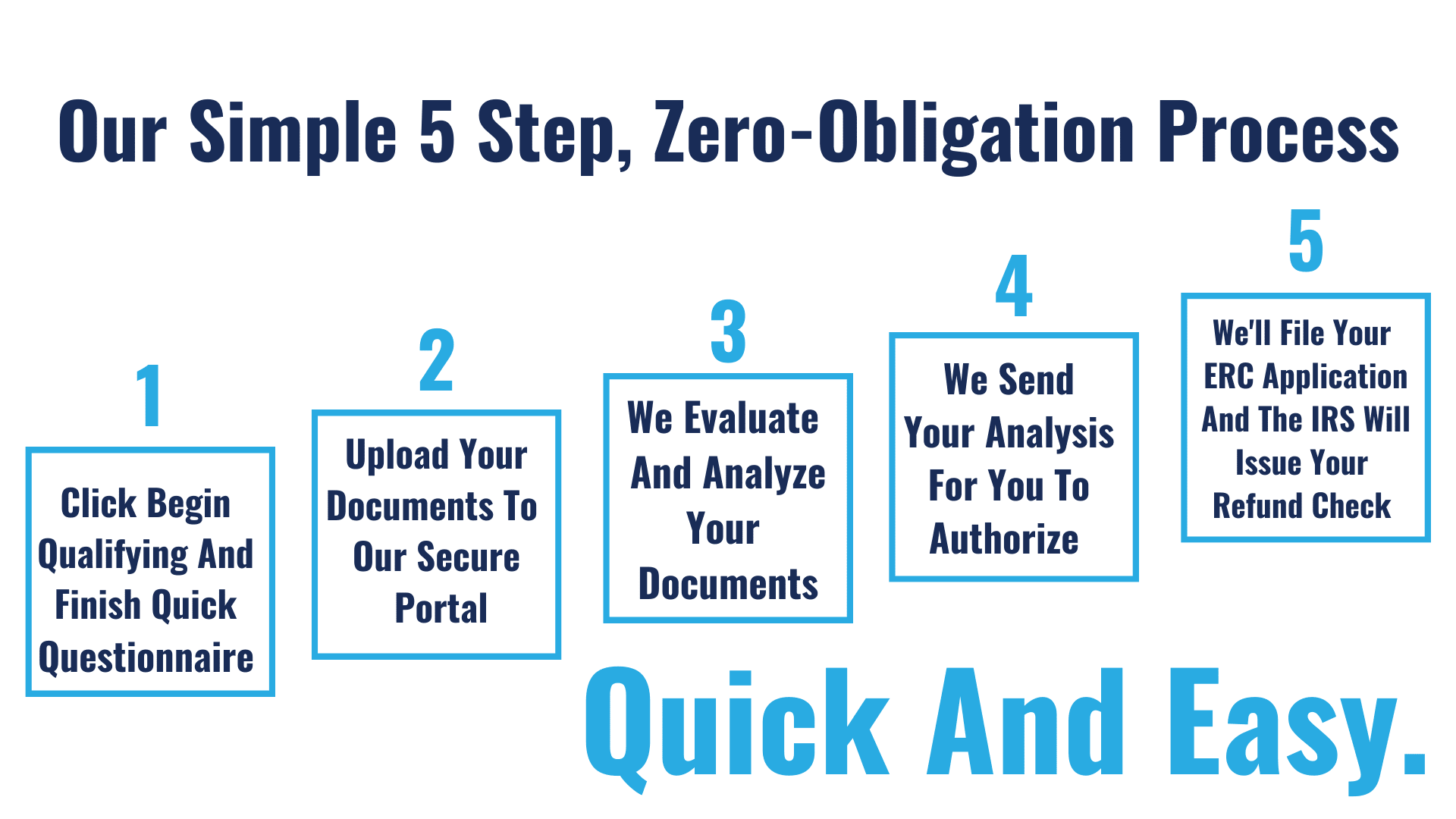

This quick introduction video is a great place to start if you are researching the Employee Retention Credit. Most of your questions can be answered by the end of this short video. If you would like to see if your business qualifies for the ERC please click "Begin Here" to start our quick zero obligation process.

Endorsed By:

Important Update about the ERC Program

ERC Specialists has closely monitored information regarding the moratorium the IRS implemented on the Employee Retention Credit (ERC) in September 2023.

We have learned there is currently a bill in Congress that, if passed, would result in the barring of any additional ERC claims from being submitted after 1/31/24. (see reference here)

Due to the significant impact of the potential passing of this bill, we have implemented the following deadlines:

- Deadline for new applications - Wednesday, 1/17/2024 @ 11:59pm MST

-

Deadline for submitted documentation - Thursday, 1/18/2024 @ 11:59pm MST

The Employee Retention Credit

Covid has created many challenges for business owners. However, the good news is the government is rewarding business owners for retaining their employees during these challenging times. As a result, you may now be eligible for Employee Retention Credits (ERC) of up to $26,000 per employee.

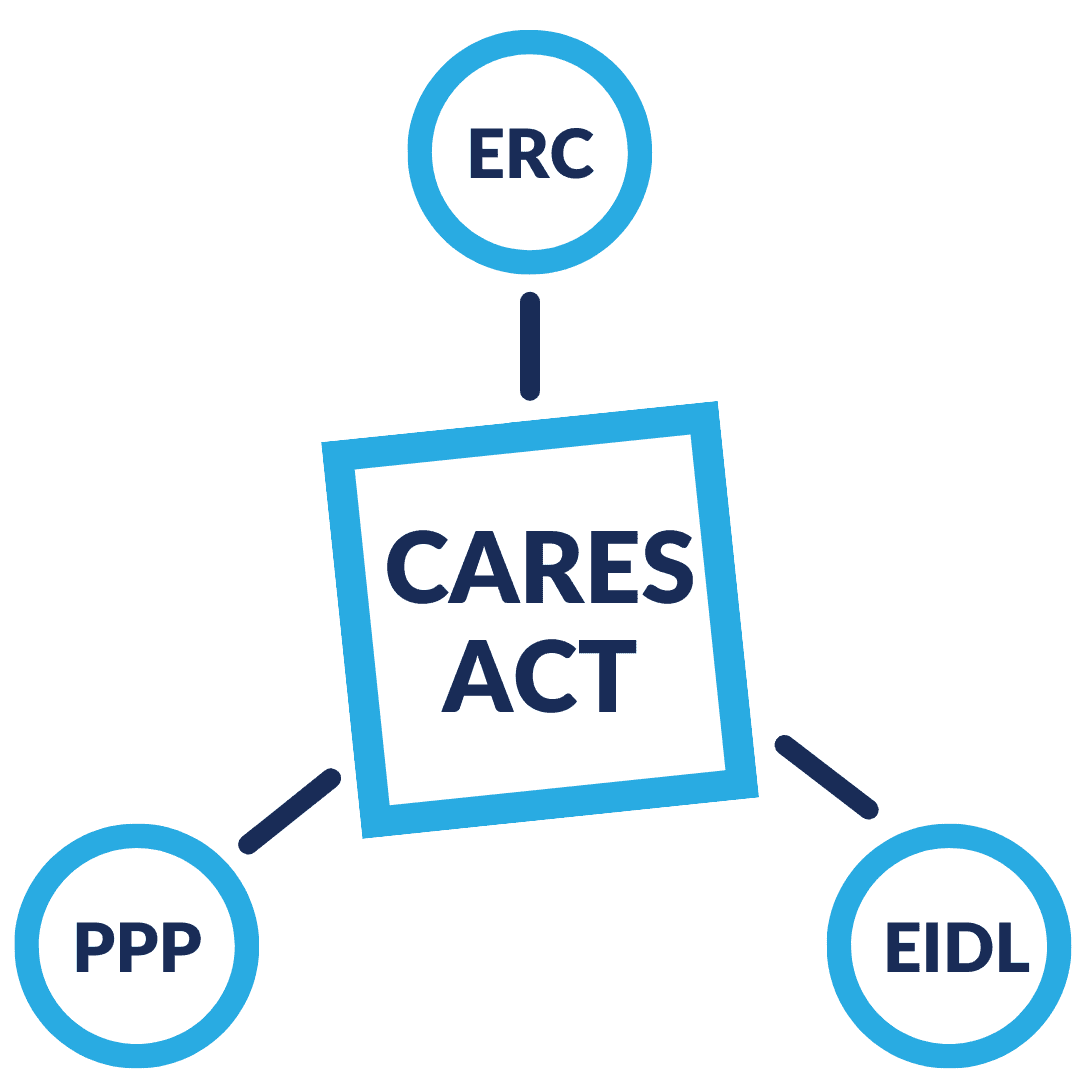

The ERC program was created under the Coronavirus Aid, Relief and Economic Security Act (CARES Act) as part of the federal government’s relief program to encourage and reward business owners that retain employees during the COVID-19 pandemic.

Recently the policy was amended to enable business owners to qualify for ERC tax credits even if they received PPP loans. The time period the program covers was also extended from March 22, 2020 to September 30, 2021. Details of the program include:

- Up to $26,000 PER EMPLOYEE

- Available for 2020 and 1st through 3rd quarters of 2021

-

No limit on funding (ERC is not a loan)

-

ERC is a refundable tax credit

IRS TAX CODE

See what the IRS has to say about the Employee Retention Credit. Below is a link to IRS.gov section regarding the ERC.

The Employee Retention Credit

Covid has created many challenges for business owners. However, the good news is the government is rewarding business owners for retaining their employees during these challenging times. As a result, you may now be eligible for Employee Retention Credits (ERC) of up to $26,000 per employee.

The ERC program was created under the Coronavirus Aid, Relief and Economic Security Act (CARES Act) as part of the federal government’s relief program to encourage and reward business owners that retain employees during the COVID-19 pandemic. Recently the policy was amended to enable business owners to qualify for ERC tax credits even if they received PPP loans. The time period the program covers was also extended from March 22, 2020 to September 30, 2021. Details of the program include:

IRS TAX CODE

See what the IRS has to say about the Employee Retention Credit. Below is a link to IRS.gov section regarding the ERC.

- Up to $26,000 PER EMPLOYEE

- Available for 2020 and 1st through 3rd quarters of 2021

- Qualify with decreased revenue, COVID related shutdown or supply chain disruption

-

No limit on funding (ERC is not a loan)

-

ERC is a refundable tax credit

IRS TAX CODE

See what the IRS has to say about the Employee Retention Credit. Below is a link to IRS.gov section regarding the ERC.

Recent Success Stories

Trusted By 1000s Of Small Businesses And CPA Firms Nationwide

Employees Qualified

200,000+

Credits Recovered

$5,000,000,000+

Businesses Reached

35,000+

Employees Qualified

200,000+

Credits Recovered

$8,400,000,000+

Businesses Reached

50,000+

ERC Qualifications

ERC Qualifications

While the general qualifications for the ERC program seem simple, the interpretation of each qualification is very complex. Our significant experience allows us to ensure we maximize any qualifications that may be available to your company. Companies must have had only ONE of the following circumstances to qualify for the Employee Retention Credit.

- Supply Chain Disruption

Supply Chain Disruption can be anything from delayed supplies, changes in product, change in packaging, etc. For example, many restaurants weren’t able to get certain types of meat, paper towels or carryout containers during the pandemic. Delivery companies couldn’t get truck parts or scanners. Hotels were unable to receive furniture, towels and sheets due to ports being shut down, which delayed renovation plans. These impacts qualify a company regardless of revenue gain or loss.

- Gross Receipts Reduction

Gross receipt reduction criteria is different for 2020 and 2021. For 2020 you must have experienced a 50% reduction of gross sales for the 2020 quarter as compared to the same quarter in 2019. When and if the revenue reduction in 2020 gets back to 80% of the 2019 level, the qualification ends. For 2021 you can qualify if you had a 20% reduction of gross sales for the 2021 quarter as compared to the same quarter in 2019.

- Full or Partial Suspension of Business Operations

A government authority required partial or full shutdown of your business during 2020 or 2021. This includes your operations being limited by commerce, inability to travel or restrictions of group meetings. This does not mean that your revenue must have decreased to use this qualification.

ERC Qualifications

While the general qualifications for the ERC program seem simple, the interpretation of each qualification is very complex. Our significant experience allows us to ensure we maximize any qualifications that may be available to your company. Companies must have had only ONE of the following circumstances to qualify for the Employee Retention Credit.

- Supply Chain Disruption

- Gross Receipts Reduction

- Full or Partial Suspension of Business Operations

A government authority required partial or full shutdown of your business during 2020 or 2021. This includes your operations being limited by commerce, inability to travel or restrictions of group meetings. This does not mean that your revenue must have decreased to use this qualification.

Ready To See If You Qualify?

Ready To See If You Qualify?

IF YOU HAD OPERATIONS OF TRADE OR BUSINESS PARTIALLY OR FULLY SHUTDOWN DUE TO COVID-19 ORDERS DURING ANY QUARTER OF 2020 YOU MOST LIKELY QUALIFY.

SOME QUALIFIERS FOR AT LEAST PARTIAL CREDIT INCLUDE:

SOME QUALIFIERS FOR AT LEAST PARTIAL CREDIT INCLUDE:

- Were your business hours limited?

-

Was your occupancy limited?

- Were you forced to close?

-

Did your physical location have restricted access?

- Were you forced to implement social distancing restrictions for employees and customers?

-

Were employees forced to work remotely?

-

Did you experience supply chain issues?

-

Did your suppliers experience disruption?

- Were your business hours limited?

-

Was your occupancy limited?

- Were you forced to close?

-

Did your physical location have restricted access?

Our expertise lies in what most CPAs don't focus on - payroll taxes.

Our expertise lies in what most CPAs don't focus on - payroll taxes.

Why ERC Specialists?

Dedicated to ERC

No need to be the guinea pig for your CPA. We average 10-20% more funding than a CPA not familiar with the program.

Maximum Funding

We evaluate your claim in every way possible to ensure we maximize your credit.

Lighting Fast Results

Our streamlined processes allow for faster results, which means faster funding.

Professional Support

Although our process is quick and painless, when you have questions we have answers with a dedicated team of ERC support specialists.

ERC Program Specialists

Our team strictly focuses on ERC allowing us to be the experts and resulting in more funding for your business.

CUSTOM JAVASCRIPT / HTML

Frequently Asked Questions

Can I Get ERC Funds If I Already Took The PPP?

Yes. The Taxpayer Certainty and Disaster Tax Relief Act of 2020, enacted December 27, 2020, modified the ERC credit rules. One of the modifications included allowing a company to have a PPP loan and still take advantage of the ERC credit. However, you can't use the same dollar for dollar funds. We take this into account when processing your ERC credit.

My Revenue Went Up In 2020, Can I Still Qualify For The ERC Program?

Do I Have To Repay The ERC Credit?

No. This is not a loan. Its a refundable tax credit. When we file your ERC claim we request a refund check for you.

I'm Getting More In ERC Credit Than I Paid In Taxes?

Remember that this program is taken according to payroll taxes paid, not on income taxes. ERC funds not applied towards owed payroll taxes are treated as an 'overdeposit' of taxes that will be requested as a refund check from the IRS.

Will The ERC Funds Run Out?

This is not a lending program - tax refunds are issued by the US Treasury. Therefore, all eligible employers will receive the funds. However, the IRS backlog grows daily. As this continues to grow the wait time for funds to be sent could grow longer and longer.

Is The ERC Credit Taxable?

No, but the IRS guidance suggests the employer portion of the FICA refunded will become an add-back against the claimed payroll expense. Once you receive your ERC refund make sure you update your CPA on the amount received for their guidance.

Can I Qualify For The ERC If I'm Self Employed?

No, this program applies to W2 payroll taxes paid. The IRS has also stipulated that spouses and children of owners paid on W2 also do not qualify for the program.

Can't I Just Have My CPA File? Why Would I Use ERC Specialists?

Yes. We also offer a referral/affiliate program. To learn more contact us.

How Much Do You Charge?

We charge a flat fee for our services based on the amount of employees that qualify for the ERC. This is in alignment with how the IRS requires tax consultants and preparers to charge for services. We calculate and provide our fee with our free analysis. Since we are typically able to recover 10-20% more than someone less familiar with the program, our fee is very affordable. Just like a good CPA, using the right team for this process pays for itself.

How Will I Pay The Fee?

We understand your refund check may not arrive for several months (16 weeks minimum according to IRS documentation), so we offer two payment options. You can choose to pay your fee up front by credit card or, if you prefer, the full fee can be deducted from your refund once received. Regardless, our fee is covered by a 100% Money Back Guarantee. If the IRS does not release the credit claimed for any reason, we will refund any payments made.

How Long Does It Take To Get My ERC Credit?

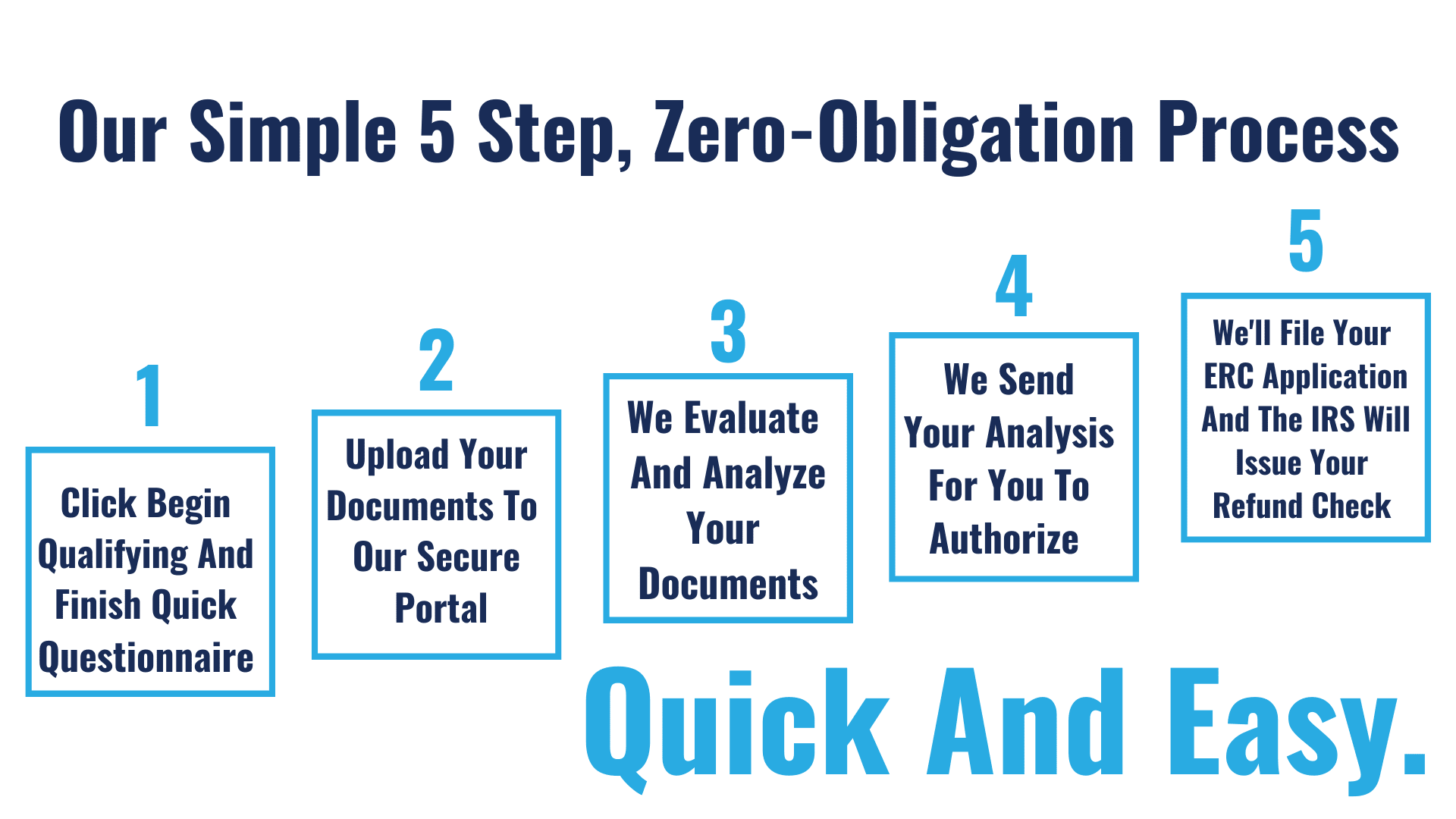

This is how the process works: you send us the required documents and we process an analysis at no charge. This analysis typically takes 3-5 days to complete. If you wish to move forward, you will select your desired payment option and we file your claim. Once filed, refunds are released based on IRS backlog. Currently, the IRS has stipulated a 16 week minimum turnaround on the ERC refunds

What Our Clients Are Saying

Frequently Asked Questions

My Revenue Went Up In 2020, Can I Still Qualify For The ERC Program?

Yes! There are two possible qualifications for 2020: revenue reduction, or a "full or partial shutdown of your business due to COVID-19". Specifically the IRS describes this as "A government authority required partial or full shutdown of your business during 2020 or 2021. This includes your operations being limited by commerce, inability to travel or restrictions of group meetings." Below are several examples of qualifying events:

Example 1: A restaurant must close or limit its on-site dining, such as having to close down every other table, due to COVID-19 restrictions.

Example 2: A business that needs to meet with clients in person and has to cancel meetings due to COVID-19 restrictions.

Example 3: A business has to reduce their operating hours because of COVID-19 restrictions and cleaning requirements.

Example 4: A business with a planned event has to cancel that event, or restrict the amount of people who can attend, due to COVID-19 restrictions.

Do I Have To Repay The ERC Credit?

No. This is not a loan. Its a refundable tax credit. When we file your ERC claim we request a refund check for you.

I'm Getting More In ERC Credit Than I Paid In Taxes?

Will The ERC Funds Run Out?

This is not a lending program - tax refunds are issued by the US Treasury. Therefore, all eligible employers will receive the funds. However, the IRS backlog grows daily. As this continues to grow the wait time for funds to be sent could grow longer and longer.

Is The ERC Credit Taxable?

No, but the IRS guidance suggests the employer portion of the FICA refunded will become an add-back against the claimed payroll expense. Once you receive your ERC refund make sure you update your CPA on the amount received for their guidance.

Can I Qualify For The ERC If I'm Self Employed?

Can't I Just Have My CPA File? Why Would I Use ERC Specialists?

Of course. The challenge is the ERC credit is taken on your payroll returns and not through your business income tax returns, which is what most CPA's handle. Because of this most CPA's don't process this credit, unless they process your payroll in house. This is also a big reason why this credit is so underutilized. Since CPA's don't typically handle it and they are the tax experts, it has mostly fallen in a middle ground where few are able to effectively process the credit. Interestingly, we receive a large portion of our clients from CPA's.

At ERC Specialists we have decades of payroll experience, which has allowed us to specifically focus on understanding and maximizing the ERC program. In our experience we have found that due to the complexity (the ERC tax code is over 200 pages) and time investment necessary to understand the ERC program, very few are able to effectively maximize this sizeable credit for your business.

I'm A CPA Or A Payroll Company, Can I Refer My Clients To ERC Specialists?

Yes. We also offer a referral/affiliate program. To learn more contact us.

How Much Do You Charge?

We charge a flat fee for our services based on the amount of employees that qualify for the ERC. This is in alignment with how the IRS requires tax consultants and preparers to charge for services. We calculate and provide our fee with our free analysis. Since we are typically able to recover 10-20% more than someone less familiar with the program, our fee is very affordable. Just like a good CPA, using the right team for this process pays for itself.

How Will I Pay The Fee?

We understand your refund check may not arrive for several months (16 weeks minimum according to IRS documentation), so we offer two payment options. You can choose to pay your fee up front by credit card or, if you prefer, the full fee can be deducted from your refund once received. Regardless, our fee is covered by a 100% Money Back Guarantee. If the IRS does not release the credit claimed for any reason, we will refund any payments made.

How Long Does It Take To Get My ERC Credit?

This is how the process works: you send us the required documents and we process an analysis at no charge. This analysis typically takes 3-5 days to complete. If you wish to move forward, you will select your desired payment option and we file your claim. Once filed, refunds are released based on IRS backlog. Currently, the IRS has stipulated a 16 week minimum turnaround on the ERC refunds

About ERC Specialists

Quick Links

© 2024 | Privacy Policy

ERC Specialists is a specialty payroll company exclusively dedicated to understanding and maximizing the CARES Act Employee Retention Credit (ERC) for small businesses affected negatively by COVID 19.

560 E. Timpanogos Circle Orem, UT 84097

Connect With Us On Social Media:

ERC Specialists, LLC DOES NOT provide any legal or accounting advice and users of this web site should consult with their own lawyer and C.P.A. for legal and accounting advice.